One explanation for why women make better investors is that women tend to have a “buy-and-hold” investing strategy versus men who tend to frequently trade, which tends to stunt performance over time. Data shows that women don’t tend to react to market fluctuations the same way that men tend to. MIT released a study that found married men over the age of 45, who consider themselves having “excellent investment experience”, are actually more likely to panic sell during a downturn. Panic selling is not a winning investment strategy.

During the recent downturn in global stock markets, Ellevest (a robo-advisor targeting women) indicated that they received net inflows of money; indicating that their clients were investing more money while the stock market was struggling. This is the first part of the saying, “Buy Low, Sell High”. While other investment companies were seeing their clients selling off their investments in fear (selling low), the likely female investors at Ellevest were taking advantage of the low prices on the stock market and reacting intelligently, not emotionally.

What makes women better investors, and what we’re doing right, is:

-

Saving a respectable portion of our income – women tend to save more than men (where we can improve is investing a higher proportion of that saved money);

-

Trading at a reasonable frequency – not trading out of fear, and keeping our eyes on the long-term goal;

-

And choosing investments that lead us to outperform men – some studies report that this is achieved by doing our homework rather than listening to a hot stock tip from someone we know.

Why don’t more women invest their money?

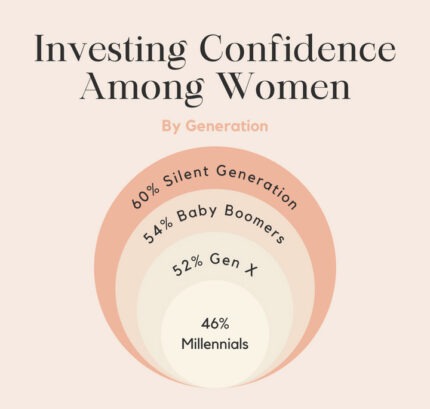

While progress is being made in terms of more women investing their money and taking proactive steps in their financial journeys, only one third of women feel confident in their ability to make investment decisions. Women have historically been less confident in their investing skills compared to men. Data shows that 71% of men assess themselves as having high levels of investment knowledge, whereas that number is 54% for women.

You could blame this on lack of education (men may be more likely to discuss finance and an informal education may be gained), and the fact that money and finance have always been predominantly centered around men. Ellevest revealed that nearly 3 quarters of all money articles that are targeted to men center around growing money and investing; in contrast, 90% of money articles targeted at women are negative and center around spending less.