Rental Market

Condos for rent have been the hardest hit segment of the real estate market. Because of the pandemic, immigration has dropped significantly that has conventionally been a key source of rental demand. It is highly likely that colleges and universities may continue virtual learning in the fall, keeping students home with mom and dad. And given the significant job losses, renters have been disproportionately affected relative to homeowners, which could sway them from leaving rent-controlled units or getting into the rental market at all.

There are several reasons why rents have been quick to fall. The surge in unemployment has most affected low-wage earners, who typically rent, and few people will commit to a new property if they are unable to view it in person. Moreover, immigration has all but stopped and the halting of tourism has caused a slump in demand for short-term rentals, so these landlords are now targeting the longer-term rental market instead.

The number of short-term rental units that could return to the Toronto market, at 7,900, is already more than the number of vacant units at the start of the year. Toronto’s population was previously growing at an average of 12,000 per month with immigration. Toronto rental vacancy rate could jump significantly by the end of the summer, if departing university students are not replaced by a new cohort as teaching increasingly moves online.

In April, new listings of furnished condos – a rough proxy for short-term rentals – in the GTA surged 91% from a year earlier, Urbanation said.

Increased Supply

Meantime, despite a short-term hiccup to construction, tens of thousands of purpose-built rental and condo units are set to be completed in Toronto this year, adding a steady stream of housing as demand cools. Many of the condos now reaching completion were sold four or five years ago as pre-construction condos.

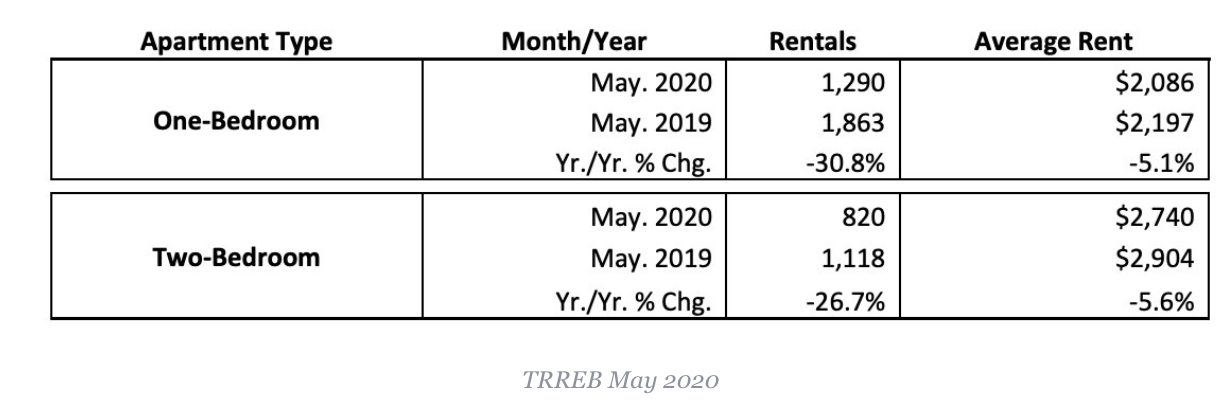

Rents

The average rent for a one-bedroom condo fell -5.1% year-over-year in May to $2,086 on average, while the number of one-bedroom rental transactions fell -30.8% annually across the GTA.

Average rents for two-bedroom units fell 5.6% to $2,740, with a 26.7% year-over-year reduction in the number of new transactions. However, the board says that, similar to home sales, there was a “marked improvement” in rental transactions in May compared to April, with nearly double the number of condos leased.